In recent years, stablecoins have emerged as a key innovation in digital finance, offering the speed of crypto with the price stability of traditional currency.

But for many finance and operations leaders, the concept still raises questions:

- What exactly are stablecoin payments?

- How do they work for B2B transactions?

- Are they compliant and secure?

This guide explains stablecoin payments in simple, practical terms, with a focus on how regulated businesses can use them today.

What Are Stablecoins?

Stablecoins are digital currencies pegged to the value of traditional fiat, like the U.S. dollar (USD) or euro (EUR). Their value remains stable, unlike Bitcoin or Ethereum, making them suitable for payments, settlements, and treasury operations.

Examples:

- USDC: Fully backed by US dollar-denominated reserves, issued by Circle (regulated in the U.S. and EU)

- EURC: A euro-pegged stablecoin for cross-border payments in Europe

Stablecoins can be transferred on public blockchains, offering global reach, low fees, and instant settlement.

How Do Stablecoin Payments Work?

Stablecoin payments function like sending money via email, but faster, cheaper, and programmable.

Here’s the typical process:

- You hold a stablecoin wallet (custodied or self-managed)

- You initiate a payment to a supplier, partner, or contractor

- Funds are transferred instantly on-chain (often in seconds)

- Recipient receives stablecoins they can hold or convert to fiat

Unlike bank wires or card networks, there’s no need for intermediaries or banking hours.

Key Advantages for Businesses

Using stablecoins for B2B payments offers several strategic benefits:

✅ Faster Settlement

- Real-time transfer (seconds instead of days)

- Always-on: weekends, holidays, global time zones

✅ Lower Transaction Costs

- No SWIFT or intermediary banking fees

- Flat or near-zero on-chain fees

✅ Global Accessibility

- Payments across borders without FX markups

- Ideal for remote payroll, suppliers, and affiliates

✅ Transparent and Auditable

- Every transaction is recorded on-chain

- Helps with reconciliation and compliance reporting

What Types of Businesses Can Use Stablecoin Payments?

Stablecoin payments are especially useful for companies operating in:

- iGaming and FX (high-volume, cross-border payments)

- Fintechs and PSPs (faster settlements, lower fees)

- Global SaaS (multi-region contractors, payouts)

- E-commerce (international suppliers and platforms)

Whether you’re sending $5,000 or $5 million, the mechanics are the same, but faster and more transparent than legacy rails.

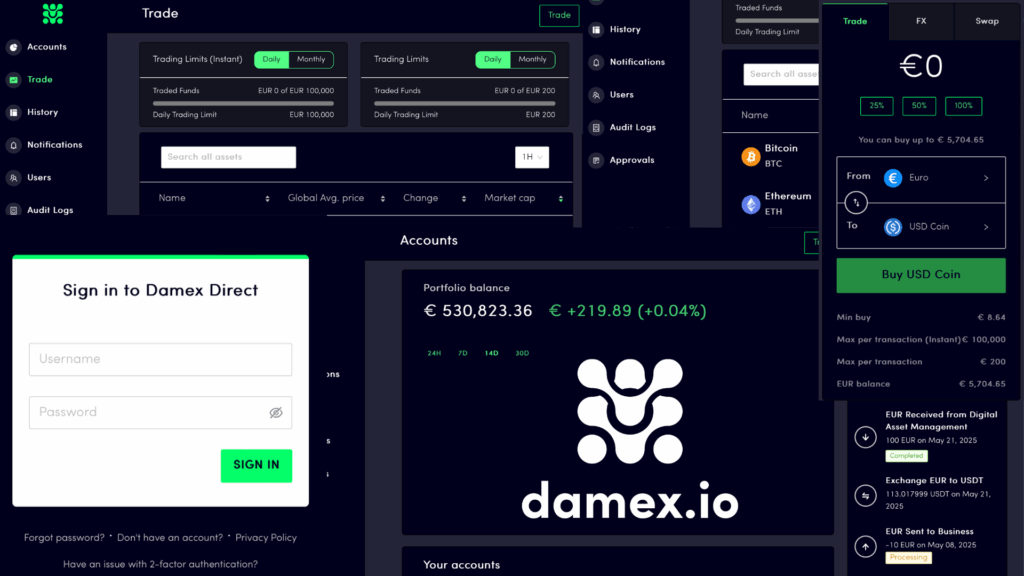

Is It Compliant?

Yes, when done through the right infrastructure. Damex offers:

- Regulated access to stablecoin rails

- KYC/KYB onboarding

- AML-compliant transfers

- Real-time reporting tools for finance and legal teams

Stablecoins aren’t “off-grid”, they can be more traceable than traditional payments.

Final Thought: Stablecoins Are Business-Ready

Stablecoin payments aren’t the future, they’re already in use by leading companies who need faster, more efficient global transfers.

With the right partner and compliance framework, finance teams can unlock speed and cost savings, without giving up visibility or control.

📞 Want to see how stablecoins can improve your business payments?

👉 Talk to a payments expert

The information contained in this article is not to be considered as financial, legal or professional advice. Services or technologies not provided by Damex referred to in this content is for information purposes only and you should consider doing your own research or ask us for further information or assistance. Any reliance placed on information is at your own risk.Damex.io is regulated in various jurisdictions. Damex provides services to institutions and sophisticated investors only and Damex’s services are not available to retail users. Information on services provided relevant to your jurisdiction and information on the unique risks that digital asset trading carries are available at damex.io/disclaimer and damex.io/risk-notice.