Introduction

Stablecoin payments are rapidly becoming the backbone of global value transfer. With over $27.6 trillion in on-chain stablecoin volume processed in 2024 alone (source: Visa), their use has moved from crypto-native users to mainstream businesses, remittance providers, and B2B platforms.

But what exactly are stablecoin payments? How do they work, and why are they reshaping global finance?

In this Ultimate Guide to Stablecoin Payments (2025), we’ll break down:

- What stablecoins are

- How stablecoin payments work

- Benefits and risks

- Real-world business use cases

- Compliance considerations

- How to get started

1. What Are Stablecoin Payments?

A stablecoin payment is a transfer of value using a cryptocurrency that is pegged to a stable fiat currency (like USD or EUR). The most common examples include:

- USDC (USD Coin) – backed 1:1 by U.S. dollars

- EURC – euro-pegged stablecoin for EU payments

Unlike highly volatile assets like Bitcoin, stablecoins are able to maintain predictable value while benefiting from blockchain speed and accessibility.

2. How Do Stablecoin Payments Work?

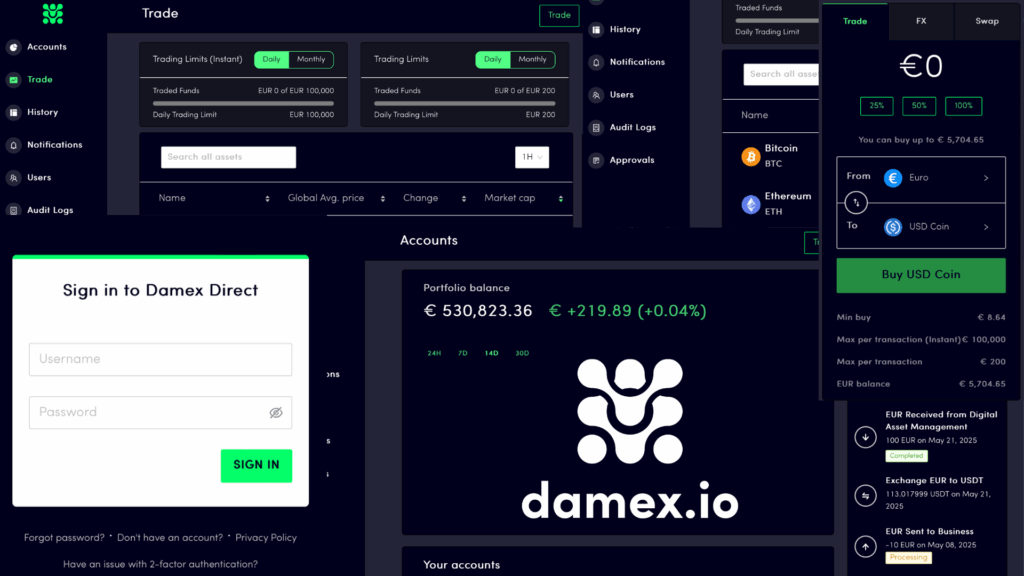

- Sender uses a wallet or platform (e.g., Damex, Metamask, or Coinbase)

- Stablecoin is transferred over a blockchain like Ethereum, Solana, or Tron

- Recipient receives the payment instantly in the same stablecoin

- Funds can be held, spent, or converted to fiat

Most stablecoin transfers settle in seconds to minutes, cost less than $1, and work 24/7 across borders.

3. Benefits of Stablecoin Payments

| Benefit | Description |

| ✅ Faster settlement | Transfers clear in seconds—no waiting 2–5 business days |

| ✅ Lower fees | On-chain fees are often <$0.50 (vs. $30+ bank wires) |

| ✅ Global access | No bank required—just a wallet and internet |

| ✅ FX risk protection | Use USD- or EUR-pegged coins to avoid currency swings |

| ✅ Full transparency | All transactions recorded on public blockchains |

Businesses using stablecoin payments reduce operational costs, accelerate working capital, and gain 24/7 financial control.

4. Use Cases for Stablecoin Payments in 2025

Cross-Border B2B Settlements

- International supplier payments

- Affiliate and partner payouts

- Intercompany treasury transfers

Remittances

- Lower fees for migrant workers sending money home

- Instant settlement in countries with limited banking access

Invoicing & Smart Contracts

- Pay-per-delivery contracts

- Automated milestone payments

- Transparent payment rails for global freelancers

High-Risk & Underbanked Industries

- iGaming, FX, crypto exchanges, and emerging markets

- Use stablecoins where banks restrict access or impose high fees

5. Stablecoin Networks: Which Blockchain Is Best?

| Blockchain | Avg. Fee | Speed |

| Ethereum | $2–$20 | 3–10 mins |

| Solana | <$0.01 | <5 sec |

| Tron (TRC-20) | <$1 | ~1 min |

| Polygon | <$0.10 | ~2 mins |

For high-volume business payments, Solana and Tron are popular for their low fees and high speed.

6. Are Stablecoin Payments Legal and Regulated?

✅ Yes,if done properly.

Regulations like the EU’s MiCA (Markets in Crypto-Assets Regulation) and the FATF Travel Rule are now in effect.

Compliance checklist:

- Use regulated stablecoins (like USDC or EURC)

- Verify users with KYC/AML

- Use providers that offer transaction screening and reporting tools

- Ensure on/off ramps are licensed (EMIs, PSPs)

Platforms like Damex are able to offer fully compliant stablecoin payment infrastructure for businesses.

7. How to Accept Stablecoin Payments in Your Business

- Choose a provider (e.g., Damex, Circle, or a crypto PSP)

- Set up a wallet or merchant gateway

- Offer USDC/EURC as a payment option

- Implement compliance protocols (KYC, reporting)

- Convert to fiat or hold on-chain for liquidity

8. Stablecoins vs. Traditional Payment Rails

| Feature | Bank Wire | Stablecoin Payment |

| Settlement time | 2–5 days | Minutes |

| Availability | Business hours | 24/7/365 |

| International fees | $25–$50 | <$1 |

| FX volatility | Yes | No (if pegged) |

| Chargebacks | Possible | Not possible |

9. Future of Stablecoin Payments

With Visa and Mastercard enabling stablecoin settlements, and central banks exploring CBDCs, the landscape is evolving fast. Stablecoin payments are becoming:

- Mainstream for business

- Critical in emerging markets

- Fully integrated into fintech stacks

As regulatory clarity improves, stablecoins are no longer just for crypto users,they’re becoming a global business standard.

Conclusion: Why Stablecoin Payments Matter in 2025

Stablecoin payments offer speed, efficiency, and transparency that traditional systems can’t match. For businesses operating globally or looking to modernize their financial workflows, they provide a powerful, programmable, and compliant payment rails.

Whether you’re managing B2B invoices, paying remote teams, or optimizing treasury flows, stablecoins are the future of payments.

The information contained in this article is not to be considered as financial, legal or professional advice. Services or technologies not provided by Damex referred to in this content is for information purposes only and you should consider doing your own research or ask us for further information or assistance. Any reliance placed on information is at your own risk.Damex.io is regulated in various jurisdictions. Damex provides services to institutions and sophisticated investors only and Damex’s services are not available to retail users. Information on services provided relevant to your jurisdiction and information on the unique risks that digital asset trading carries are available at damex.io/disclaimer and damex.io/risk-notice.