In a world where capital efficiency is everything, waiting 2–5 business days for funds to settle is more than a delay, it’s a strategic handicap.

For companies in regulated industries, like fintechs, FX brokers, PSPs, and iGaming, traditional settlement cycles create liquidity gaps, reconciliation overhead, and hidden costs. With stablecoin-powered infrastructure, real-time settlement is not only possible, it’s becoming a competitive edge.

Why Speed Matters: Capital Efficiency and Operational Visibility

Potential real-time settlement can enable CFOs and treasury teams to:

- Free up working capital that’s usually locked in transit

- Improve cash forecasting with instant visibility on inflows and outflows

- Accelerate reconciliation, removing multi-day lags across departments

This translates into higher capital utilization, reduced risk, and better alignment between finance and operations.

The Hidden Costs of Delayed Settlement

Beyond the obvious delays, traditional payment systems introduce operational inefficiencies:

- Manual reconciliation between systems and partners

- Cash buffers to account for uncertainty in timing

- FX risk exposure due to lag between trade and settlement

- Increased back-office headcount to handle exceptions

These issues don’t scale, and they compound as volume grows.

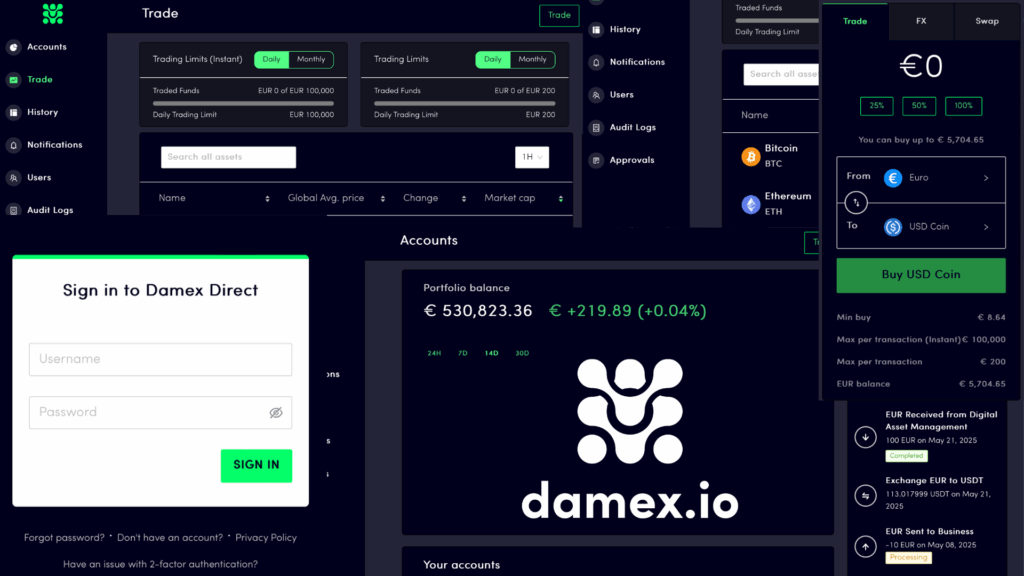

The Architecture of Real-Time Settlement Using Stablecoins

Stablecoin rails (e.g. USDC) operate on-chain, allowing financial value to move globally in seconds, 24/7. With Damex infrastructure:

- Payments are settled wallet-to-wallet, bypassing correspondent banks

- Every transaction is recorded on-chain, creating instant auditability

- Liquidity can be managed programmatically via API

Real-time means:

✅ The payment is executed

✅ The receiver has the funds

✅ The ledger is updated, all in under a minute

What Real-Time Settlement Looks Like in Practice

Let’s compare:

| Scenario | Traditional Rails | Damex + Stablecoin Rails |

| Settlement time | 2–5 business days | < 60 seconds |

| Visibility | Delayed, fragmented | Real-time, on-chain |

| FX conversion | Bank spread + delay | Automated, fair market rate |

| Reconciliation effort | Manual, high-touch | Programmatic, API-driven |

| Capital efficiency | Limited | Optimized |

Why Regulated Doesn’t Mean Slow

Contrary to the myth, real-time doesn’t mean non-compliant. With the right infrastructure:

- All participants are KYC’d

- Payments are AML screened in real time

- Reporting can be automated and scaled, not reactive

Damex delivers this through a regulated framework, allowing speed and compliance to co-exist.

Final Thought: Time is Capital

In regulated payments, speed isn’t a luxury, it’s a multiplier. Faster settlement means better capital deployment, fewer operational errors, and more strategic agility.

For CFOs and payment leaders, embracing real-time flows is not a question of if, but when.

The information contained in this article is not to be considered as financial, legal or professional advice. Services or technologies not provided by Damex referred to in this content is for information purposes only and you should consider doing your own research or ask us for further information or assistance. Any reliance placed on information is at your own risk.Damex.io is regulated in various jurisdictions. Damex provides services to institutions and sophisticated investors only and Damex’s services are not available to retail users. Information on services provided relevant to your jurisdiction and information on the unique risks that digital asset trading carries are available at damex.io/disclaimer and damex.io/risk-notice.