For many finance leaders, Bitcoin is still associated with retail speculation. But for a growing number of forward-looking CFOs, Bitcoin is entering the conversation as a strategic treasury asset.

In an era of FX volatility, inflationary pressure, and diversification needs, Bitcoin offers more than upside, it offers resilience. With a proper compliance framework and secure custody, holding Bitcoin on the balance sheet is becoming a legitimate financial strategy.

Personal vs Corporate Bitcoin Holdings: What’s the Difference?

Holding Bitcoin personally is straightforward. Holding it corporately is not.

A company must consider:

- Accounting treatment (e.g., impairment under IFRS or GAAP)

- Tax implications (capital gains, VAT exposure)

- Custody and key management

- Governance and internal controls

Without a clear operational framework, what seems like a bold move can become a compliance risk.

Use Cases: Why CFOs Are Considering Bitcoin

Bitcoin doesn’t need to replace fiat reserves to be useful. It can complement them in several ways:

🔹 FX Hedging

Bitcoin is increasingly viewed as a hedge against emerging market currency depreciation.

🔹 Long-Term Store of Value

Amid inflation and fiat devaluation, BTC serves as a non-sovereign reserve asset, an alternative to cash or even gold.

🔹 Balance Sheet Diversification

Adding BTC introduces a non-correlated asset to a corporate treasury portfolio, improving risk-adjusted exposure.

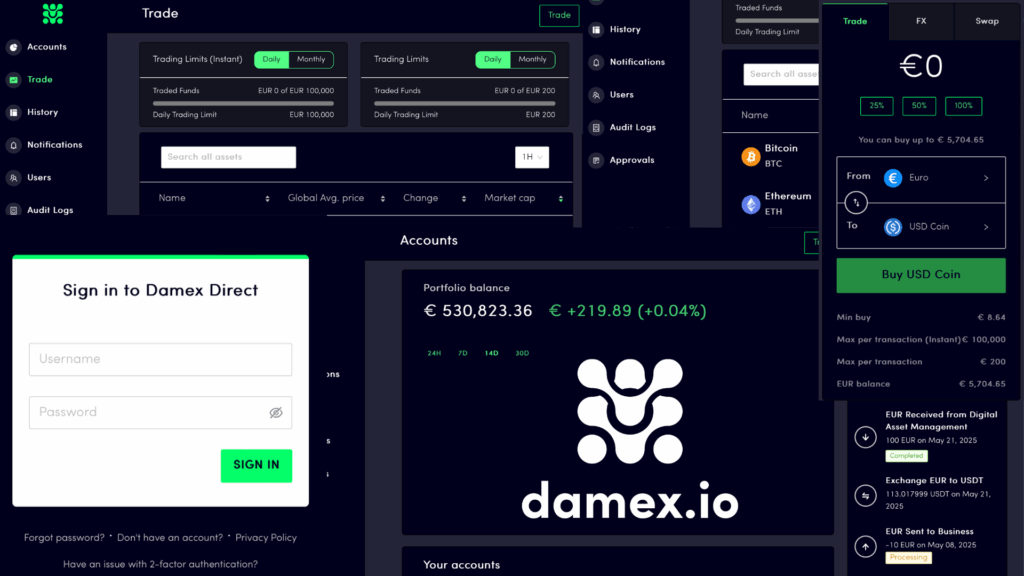

How Damex Enables Strategic Bitcoin Adoption

Damex provides regulated infrastructure that allows CFOs to acquire, custody, and manage BTC with full visibility and compliance:

- Regulated custody with institutional-grade security

- KYC/KYB onboarding and AML monitoring

- Auditable transaction history and automated reporting

- Treasury dashboards with fiat/crypto valuation tools

You don’t need to be a crypto-native CFO, you just need the right partner.

Questions Every CFO Should Ask Before Holding BTC

Before adding Bitcoin to the balance sheet, ask:

- What are the accounting implications in my jurisdiction?

- How do I protect private keys without operational risk?

- Can I access liquidity quickly if needed?

- Is my provider regulated and insured?

With Damex, you get answers, and a compliant structure to move forward with confidence.

Final Thought: Bitcoin Is a Treasury Tool, When Done Right

Bitcoin is a strategic layer in treasury planning that can provide diversification, protection, and financial agility, especially in uncertain macro environments.

The key is doing it securely, transparently, and within regulation.

Curious about Bitcoin for your treasury?

The information contained in this article is not to be considered as financial, legal or professional advice. Services or technologies not provided by Damex referred to in this content is for information purposes only and you should consider doing your own research or ask us for further information or assistance. Any reliance placed on information is at your own risk.Damex.io is regulated in various jurisdictions. Damex provides services to institutions and sophisticated investors only and Damex’s services are not available to retail users. Information on services provided relevant to your jurisdiction and information on the unique risks that digital asset trading carries are available at damex.io/disclaimer and damex.io/risk-notice