The Regulatory Status of Stablecoins in 2025

Most jurisdictions are now providing clear guidance, and major stablecoin issuers are regulated financial entities.

🔹 In the EU: MiCA

The Markets in Crypto-Assets (MiCA) framework, in effect across Europe, provides comprehensive rules on:

- Issuer licensing

- Reserve requirements

- Transparency and reporting

- Consumer protection and AML

🔹 In the UK: FCA

The Financial Conduct Authority (FCA) regulates cryptoasset businesses, including those offering custody and payment services, under anti-money laundering (AML) and e-money rules.

🔹 In the US: Stablecoin-specific bills

Stablecoin regulation is evolving under federal and state guidance (e.g., NYDFS), with frameworks focusing on 1:1 backing, audits, and issuer oversight.

The result? Regulatory clarity is here, and it favors companies working with licensed partners.

Key Questions Every CFO Should Ask

Before integrating stablecoin payments, your finance or legal team should ask:

- Who is issuing the stablecoin?

Is it fully backed, audited, and regulated? - Who is the infrastructure partner?

Are they licensed and compliant? - What compliance tooling is included?

Does the solution offer KYC, AML, and transaction monitoring? - Can the flows be audited?

Are records transparent, traceable, and exportable for regulators?

With Damex, the answer to all of the above is yes.

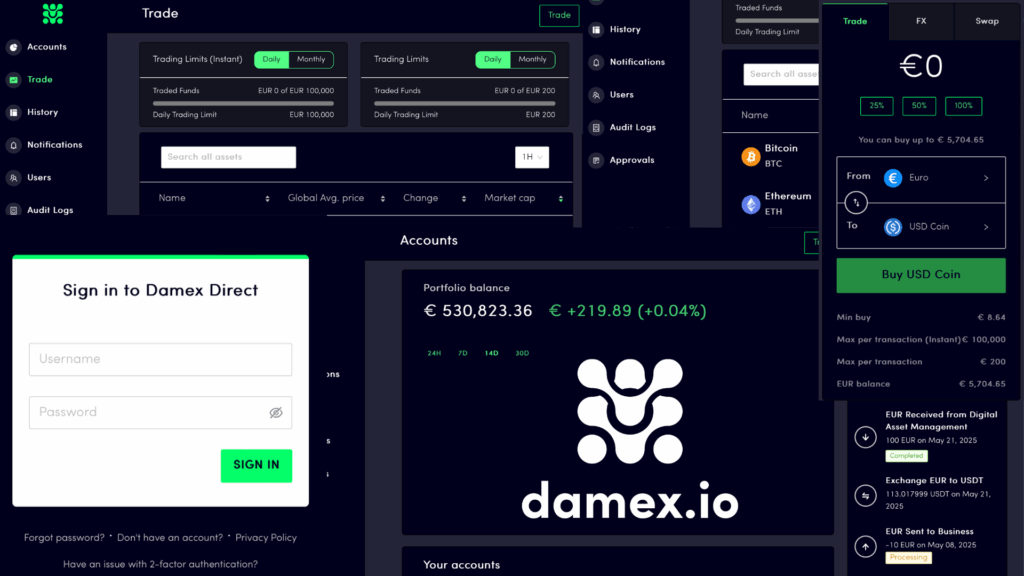

How Damex Ensures End-to-End Compliance

Damex is purpose-built for regulated industries. Our platform provides:

✅ Licensing coverage (EU, Gibraltar and other jurisdictions)

✅ KYC/KYB onboarding for all counterparties

✅ Real-time AML monitoring and sanctions screening

✅ Stablecoin custody and transaction flow auditability

✅ Data retention and export-ready compliance reports

✅ Alignment with MiCA, FATF, and local frameworks

Whether you’re operating in Europe, or globally, Damex helps you stay compliant and audit-ready.

What About Tax and Accounting?

Stablecoins can be recorded as digital assets or cash equivalents, depending on jurisdiction and accounting treatment.

Damex provides:

- Valuation tools for crypto-to-fiat at time of receipt or payment

- Reporting exports compatible with ERP, accounting, and tax software

- Support for auditors and finance controllers during review periods

Our goal is to make stablecoins operationally invisible and financially transparent.

Final Thought: Compliance Is a Feature, Not a Barrier

Stablecoin payments aren’t inherently unregulated, they’re just new. With the right infrastructure and guidance, they can become more traceable, faster to audit, and more secure than legacy systems.

For CFOs, this isn’t about taking unnecessary risks. It’s about choosing smarter rails that give your company financial agility, without losing control.

🔐 Have questions about compliance and stablecoin usage?

👉 Talk to a Damex Advisor

The information contained in this article is not to be considered as financial, legal or professional advice. Services or technologies not provided by Damex referred to in this content are for information purposes only and you should consider doing your own research or ask us for further information or assistance. Any reliance placed on information is at your own risk.Damex.io is regulated in various jurisdictions. Damex provides services to institutions and sophisticated investors only and Damex’s services are not available to retail users. Information on services provided relevant to your jurisdiction and information on the unique risks that digital asset trading carries are available at damex.io/disclaimer and damex.io/risk-notice.