En los últimos años, stablecoins han surgido como una innovación clave en las finanzas digitales, ofreciendo la velocidad de las criptomonedas con la estabilidad de precios de la moneda tradicional.

Pero para muchos responsables de finanzas y operaciones, el concepto sigue planteando dudas:

- ¿Qué son exactamente los pagos con stablecoin?

- ¿Cómo funcionan en las transacciones B2B?

- ¿Cumplen la normativa y son seguras?

Esta guía explica los pagos con stablecoin en términos sencillos y prácticos, centrándose en cómo las empresas reguladas pueden utilizarlos hoy en día.

¿Qué son las Stablecoins?

Las stablecoins son monedas digitales vinculado al valor del dinero fiduciario tradicionalComo el dólar estadounidense (USD) o el euro (EUR). Su valor se mantiene estable, a diferencia de Bitcoin o Ethereum, lo que las hace adecuadas para pagos, liquidaciones y operaciones de tesorería.

Ejemplos:

- USDC: Totalmente respaldado por reservas denominadas en dólares estadounidenses, emitido por Circle (regulado en EE.UU. y la UE).

- EURC: Una stablecoin en euros para pagos transfronterizos en Europa

Las Stablecoins pueden transferirse en cadenas de bloques públicas, ofreciendo alcance mundial, comisiones bajas y liquidación instantánea.

¿Cómo funcionan los pagos con Stablecoin?

Los pagos con Stablecoin funcionan como el envío de dinero por correo electrónico, pero más rápido, barato y programable.

Este es el proceso típico:

- Tienes un monedero stablecoin (custodiado o autogestionado)

- Usted inicia un pago a un proveedor, socio o contratista

- Los fondos se transfieren instantáneamente en la cadena (a menudo en segundos)

- El destinatario recibe stablecoins pueden mantener o convertir en fiat

A diferencia de las transferencias bancarias o las redes de tarjetas, no se necesitan intermediarios ni horarios bancarios.

Principales ventajas para las empresas

El uso de stablecoins para pagos B2B ofrece varias ventajas estratégicas:

✅ Liquidación más rápida

- Transferencia en tiempo real (segundos en lugar de días)

- Siempre activa: fines de semana, festivos, husos horarios internacionales

✅ Menores costes de transacción

- Sin comisiones SWIFT ni intermediarios bancarios

- Comisiones en la cadena planas o casi nulas

Accesibilidad global

- Pagos transfronterizos sin recargos por cambio de divisas

- Ideal para nóminas a distancia, proveedores y afiliados

✅ Transparente y auditable

- Cada transacción se registra en la cadena

- Ayuda con la conciliación y los informes de cumplimiento

¿Qué tipos de empresas pueden utilizar Stablecoin Payments?

Los pagos con Stablecoin son especialmente útiles para las empresas que operan en:

- iGaming y FX (pagos transfronterizos de gran volumen)

- Fintechs y PSP (liquidaciones más rápidas, comisiones más bajas)

- SaaS mundial (contratistas multirregión, pagos)

- Comercio electrónico (proveedores y plataformas internacionales)

Tanto si envías $5.000 como $5 millones, la mecánica es la misma, pero más rápida y transparente que los raíles heredados.

¿Cumple la normativa?

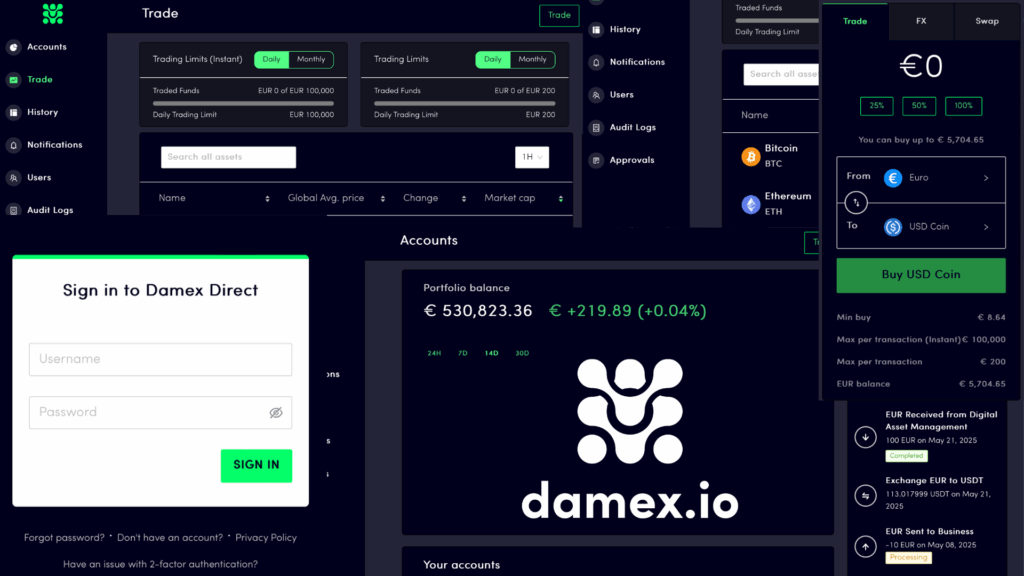

Sí, cuando se hace a través de la infraestructura adecuada. Damex ofrece:

- Acceso regulado a los raíles stablecoin

- Incorporación de KYC/KYB

- Transferencias conformes con la normativa AML

- Herramientas de información en tiempo real para equipos financieros y jurídicos

Las stablecoins no están "fuera de la red", pueden ser más rastreables que los pagos tradicionales.

Reflexión final: Las stablecoins están preparadas para los negocios

Los pagos con Stablecoin no son el futuro, ya los utilizan empresas líderes que necesitan transferencias globales más rápidas y eficientes.

Con el socio y el marco de cumplimiento adecuados, los equipos financieros pueden desbloquear la velocidad y ahorrar costessin renunciar a la visibilidad ni al control.

📞 ¿Quieres ver cómo las stablecoins pueden mejorar los pagos de tu negocio?

👉 Hable con un experto en pagos

La información contenida en este artículo no debe considerarse asesoramiento financiero, jurídico o profesional. Los servicios o tecnologías no proporcionados por Damex a los que se hace referencia en este contenido son sólo para fines informativos y usted debe considerar hacer su propia investigación o pedirnos más información o asistencia. Cualquier confianza depositada en la información es bajo su propio riesgo.Damex.io está regulado en varias jurisdicciones. Damex presta servicios únicamente a instituciones e inversores sofisticados y los servicios de Damex no están disponibles para usuarios minoristas. La información sobre los servicios prestados pertinentes a su jurisdicción y la información sobre los riesgos únicos que conlleva el comercio de activos digitales están disponibles en damex.io/disclaimer y damex.io/aviso-riesgo.